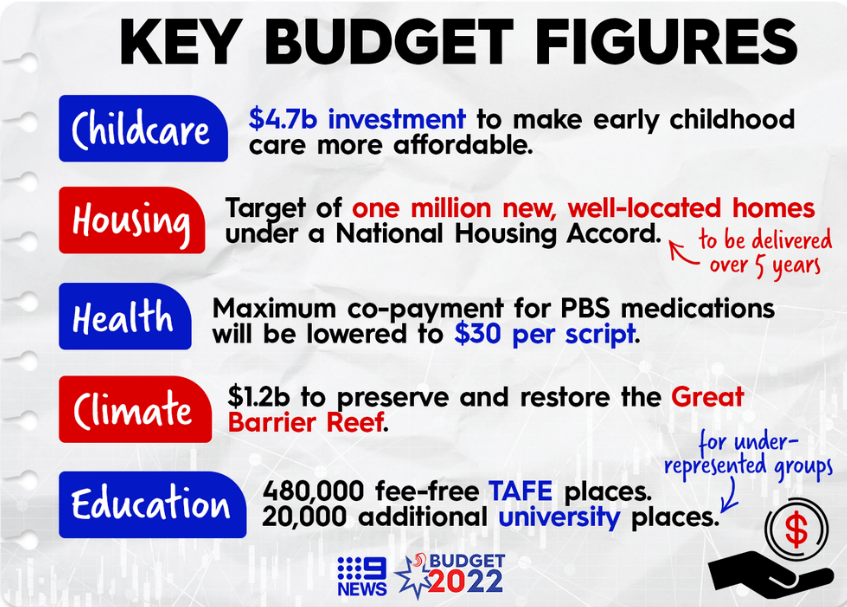

Australian families were the winners in October’s budget, with 4.7 billion over four years to make childcare cheaper. From July 2023 families who earn a household income of less than $530,000 will see their child care subsidy rate increase. Families who earn less than $80,000 will see their total childcare subsidy rate lift from 85 per cent to 90 per cent.

The Paid parental leave scheme will increase to 26 weeks or six months by July 2026. Currently the paid parental leave scheme offers 18 weeks paid at the minimum wage and an additional two weeks of flexible paid leave.

Small business was billed as the engine room of the economy in the budget so we feel the new spending measure is small bananas – a $15 million debt help and counselling hotline. For more details, read more at https://www.dfat.gov.au/about-us/corporate/portfolio-budget-statements/budget-highlights-2022-23 – or call Pinkertons Accountants.